The parallels and perils of growth

Growth is good!

Business, politicians and society continually seek growth and the economic expansion, prosperity and possibilities progress offers. Unconstrained growth is not without challenge — growth of debt, growth of imbalance … or growth of my waistline – all can be deemed negative events. As the economy continues to digest governments growth stimulation, the belching and gas of growth needs to be considered.

Infrastructure

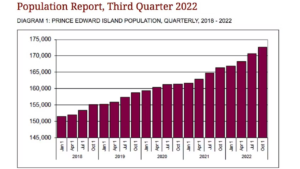

We have witnessed human capital growth; our population grew by 3.6 per cent last year and we have now exceeded 170,000 people residing in our province. This is an important economic indicator but requires appropriate infrastructure. In many cases infrastructure has not kept pace: transportation infrastructure is playing catch-up, health care may never catch up and education lags in realignment of system constraints.

Housing is another knee-jerk policy laggard. With a managed population plan (for instance 200,000 within five years is our current trajectory), where will the population be accommodated?

Statistics Canada data shows Prince Edward Island’s population was estimated to be 172,707 as of Oct. 1, 2022. This represents a yearly increase of 6,272 persons, the highest year-over-year increase on current record. princeedwardisland.ca – Contributed

Rising interest rates are cooling the sector with a decline in building permits of 4.3 per cent from last year and a decline of 6.5 per cent in year-over-year residential permit requests. These natural slowdowns are not aligned directly to increasing financing costs, or property owners’/ developers’ vitriolic dispute with government’s taxation on property owners, eight per cent in 2021 and 8.9 per cent in 2022; denying inflations input cost impacts while continuing to stoke inflation.

Building permits and starts are backed up to two years into the system. The true measure will occur in 2025, when we can see if developers are pulling projects for other markets or cancelling commitments.

Inflation

Government is attempting to tame inflation, but it’s a tiger. More people are working, so unemployment continues to decline. Employment grew 4.3 per cent last year (unemployment declined 17.5 per cent). Having people working is a government priority – but with high inflation, government needs to see people displaced from the market, job openings increase and wages fall. Average weekly earnings are also increasing year-over-year. The inflation fight is far from over.

Last year we exported a staggering $1.8 billion, an increase of 19.1 per cent. Total farm receipts grew 26.5 per cent year-over-year. And consumers are spending, retail sales grew 7.3 per cent between 2021 and 2022. These are all excellent metrics, except when they are trending against the policy of government. The more economic success we have, the more challenging the retracement to a lower baseline. Government actually needs to see consumerism slow.

The sooner we complete the necessary deflationary cycle, the faster we can get back to a strong and balanced economy.

With a strong economy and people working, a political strategist would say it’s a perfect time to get to the polls. A pragmatist would say, the growth will stall, investment will slow, and we need to plan now for the challenge around the corner of recovery. But politics and pragmatism rarely align.

We are presently swimming upstream. The progress we are making is getting harder and eventually the current will win. The sooner we complete the necessary deflationary cycle, the faster we can get back to a strong and balanced economy.

With growth comes consequences. The parallel, or corollary, to a strong economy is a correction. Recognizing these cycles creates opportunity as we await our next cycle, the slowdown.

Blake Doyle is a business columnist with SaltWire Network in Prince Edward Island.